The end of business is often the liquidation of a limited liability company or a sole proprietorship. However, can the tax authorities carry out control activities after such liquidation?

Limited liability company

Pursuant to Article 272 of the Polish Commercial Companies Code, the company is dissolved after liquidation, when the company is removed from the register.

On the other hand, according to well-established jurisprudence, the legal existence of a limited liability company ceases when it is deleted from the National Court Register. For example, the Supreme Administrative Court in its decision of 19 October 2011 (file ref. number I FSK 1502/10) indicated that:

“The events listed therein result in the initiation of liquidation proceedings, which, if completed, will result, in accordance with Article 272 of the Commercial Companies Code, in the deletion of the company from the register. Therefore, the moment of dissolution of the company is not the moment when the cause occurs, but deletion from the register as a consequence of liquidation or bankruptcy proceedings. The legal existence of the company ceases to exist at the moment of its deletion from the National Court Register.”

In addition, it should be noted that the (Polish) Tax Ordinance does not provide for the continuation of legal existence or any form of legal succession in the case of a limited liability company that has been deleted from the National Court Register.

The provisions of Articles 93-106 and 116 of the Tax Ordinance refer only to the liability of management board members for the company’s tax liabilities, and not to the further operation of the entity itself. After the company has been removed from the register as a legal person that no longer exists, it is impossible to conduct any action against it, because there is no entity to which it could refer.

In accordance with Article 133 § 1 of the Tax Ordinance a party to the tax proceedings is the taxpayer, remitter, collector or their legal successor, as well as a third party referred to in Articles 110-117c, who, due to their legal interest, requests the action of the tax authority to which the action of the tax authority relates or whose legal interest is affected by the action of the tax authority.

In a situation where a limited liability company has ceased to operate in legal transactions, it also loses standing to be a party to tax proceedings, which is tantamount to the impossibility of conducting tax proceedings against the company. The above interpretation is confirmed by the District Administrative Court in Gliwice in its decision of 10 June 2013 (file ref. number III SA/Gl 1874/12).

Going further, it should be pointed out that according to Article 281 § 1 of the Tax Ordinance, the tax authorities of the first instance carry out a tax audit of taxpayers, remitters, collectors and legal successors, hereinafter referred to as “audited”.

Thus, the dissolution of a limited liability company and its deletion from the register results in the loss of legal personality. Therefore, there are no legal grounds for initiating a tax audit against such an entity. The same applies to customs and tax inspections.

However, it cannot be ruled out that under Article 116 § 1 of the Tax Ordinance, members of the management board will be liable for tax arrears if they fail to prove that:

a) a bankruptcy petition was filed in due time or restructuring proceedings were opened at that time, or an arrangement was approved in the proceedings for approval of the arrangement, or

b) the failure to file a bankruptcy petition was through no fault of his own.

In practice, there are situations where inspections are initiated against companies in liquidation – so as to adjudicate on the tax assessment even before its liquidation. Such an open procedure also delays the liquidation process itself.

Sole proprietorship

The situation is different here. A natural person – despite the deregistration of the business – continues to exist as a legal entity and remains responsible for his tax liabilities arising during the course of his business.

Termination of business activity entered in Pol. CEIDG does not exclude the possibility of conducting verification activities, tax proceedings, tax audit or customs and fiscal control against the former entrepreneur to the extent that they relate to the period of conducting business activity – until the statute of limitations for tax liabilities expires.

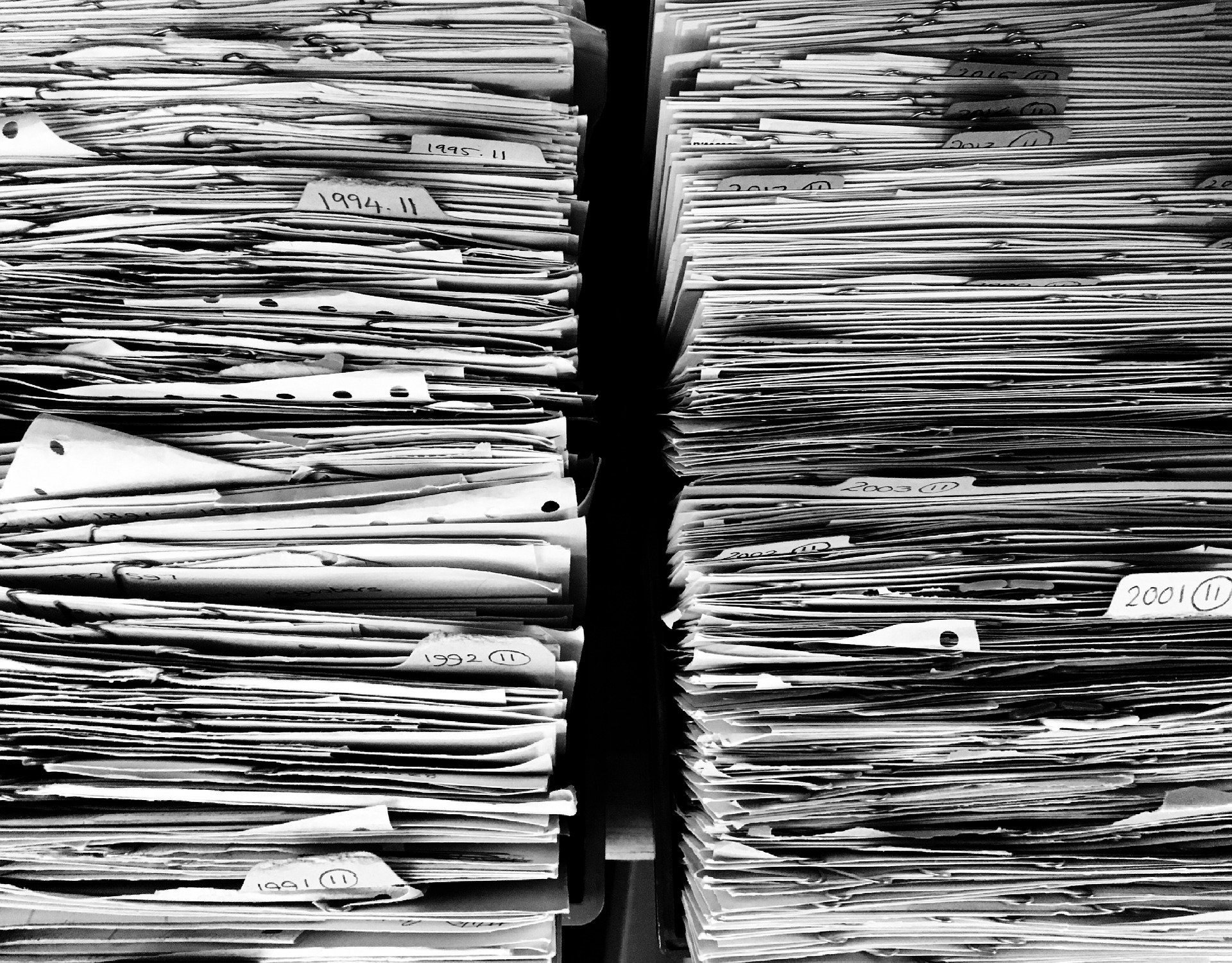

Documents after liquidation

We also note that the provisions of the Tax Ordinance require the storage of certain documents – until the statute of limitations for the tax liability expires – even if the entity has already been liquidated:

- Article 32 of the Tax Ordinance (applies to remitters and collectors);

- Article 86 of the Tax Ordinance (taxpayers – tax books);

- Article 88 of the Tax Ordinance (bills).